What Is Builder’s Risk Insurance Policy?

Builder’s risk insurance, also known as builder’s risk or construction risk insurance, is a specialised type of property insurance that provides financial protection during a construction project. It covers buildings and structures that are under construction or renovation, along with materials, fixtures, and equipment used on-site.

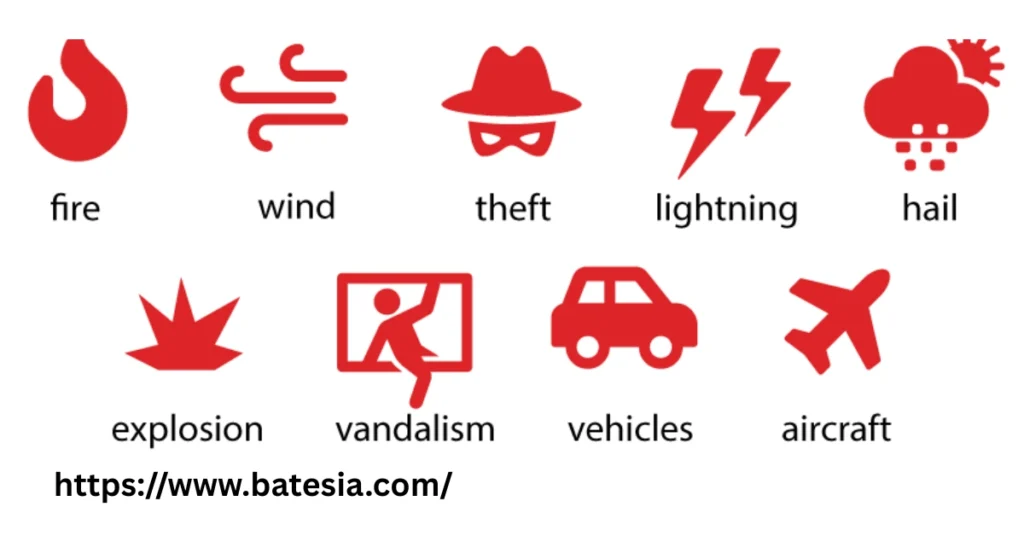

The builders risk insurance definition includes protection against perils such as fire, theft, vandalism, wind, and sometimes water damage. This insurance is critical for contractors, builders, property developers, and even homeowners undertaking a large renovation.

What Does Builders’ Risk Insurance Cover?

A builder’s risk insurance policy typically covers property on a construction site when it’s damaged or destroyed by fire, wind, or other accidents. Some builder’s risk policies also cover on-site construction materials, Temporary structures like scaffolding, Fixtures, and equipment on-site.

However, this builder’s insurance policy does not usually cover general liability, accidents, or injuries. For those risks, you’ll need additional builders’ liability insurance. Always review your builder’s risk policy to understand exactly what the coverage includes.

Who Needs Builders Risk Insurance?

All constructions should have a Builder’s Risk policy even if you take necessary precautions. They have a lot of risks, which can delay a project. This insurance keeps you protected in case of loss or damage.

Here is a list of ordinary people we insure daily.

- Property owners

- Builders and contractors

- House flippers

- Subcontractors

- Architects and engineers

What Types of Builders Risk Projects Are Eligible?

Builders risk insurance can be applied to a wide range of eligible projects, including:

- New residential or commercial buildings

- Home remodelling or renovations

- Modular building installations

- Office expansions

- Interior build-outs

When Should You Purchase Builder’s Risk Insurance?

The best time to purchase builder risk insurance is before construction starts. Once materials are delivered or ground is broken, your ability to secure coverage may be limited or more expensive. To comply with builders risk insurance requirements, confirm that the policy is active throughout the entire course of construction.

What Does Builders Risk Insurance Cost?

The builders risk insurance cost typically ranges from 1% to 4% of the total construction cost. For example, a $300,000 project may have a premium of $3,000 to $12,000. In addition to the project cost, the following factors can affect the cost of a builder’s risk insurance policy:

- Project value and type

- Location

- Size of the construction site

- Project duration

- Amount of coverage

- Policy limits and deductibles

- Quality of materials used in the construction

Before getting a business insurance quote for builder’s risk insurance, calculate your construction budget.

What Types of Builders Risk Insurance Policies Are Available?

You can choose from various builders risk insurance policies, including:

- Standard policies covering common perils

- Builders risk with wind coverage for hurricane-prone zones

- All-risk builders insurance that includes all risks unless excluded

- Policies with builder’s risk endorsement for soft costs and delays

It’s also important to look at construction insurance policies that include broader coverage for materials off-site, in transit, or at temporary storage.

How Do You Choose a Builder’s Risk Insurance Company?

When selecting a builder’s risk insurance company, consider:

Competitive rates on builders insurance coverage

Their experience with insurance for building and construction

Policy flexibility and optional endorsements

Reputation and client reviews

Industry-specific expertise in construction insurance for builders

Conclusion

If you’re planning a construction project and want reliable coverage, it’s essential to work with experienced professionals who understand the ins and outs of builders risk insurance. At Bates Insurance Agency, we specialise in providing tailored insurance solutions for builders, contractors, and property owners. Visit our website to get a personalised builder’s risk insurance quote and learn how we can help you protect your investment from day one.

Frequently Asked Questions (FAQs)

What is builders’ risk insurance?

Builders risk insurance is a type of property insurance that protects buildings and structures under construction or renovation. It’s also known as builder’s risk, builder’s risk insurance, or construction insurance.

What does builders’ risk insurance cover?

It covers the structure, materials, tools, equipment, and sometimes soft costs like labour and permits. It protects against losses caused by fire, theft, vandalism, and some weather-related damages.

How much is builders’ risk insurance?

The cost usually ranges from 1% to 4% of the total project cost. Prices vary depending on the location, project type, duration, and insurance limits.

Who pays for builders’ risk insurance?

Typically, the property owner or general contractor pays for builders’ risk insurance. The responsible party should be clearly stated in the construction agreement.

Who is responsible for builders’ risk insurance?

Responsibility varies by project but is generally assigned to the project owner or lead contractor. Always check the contract to confirm who is required to carry the builder’s insurance policy.

Do I need builders’ risk insurance?

Yes, if you’re building, remodelling, or renovating any structure, you likely need builders risk insurance. It helps protect your investment from unexpected financial loss.

Who offers builder’s risk insurance?

Many national and local providers offer builder’s risk insurance policies. Look for companies that specialise in construction insurance and offer flexible options like builder’s risk policy coverage and endorsements.